auditor independence tax services

An auditor is required to be independent from the entity it audits. One implication of this result is that restricting tax services by auditors of poorly performing firms may diminish the quality of auditors reporting decisions without leading.

Providing other tax services.

. That is 1 An auditor cannot function in the role of management 2 an auditor cannot audit his or her own work 3 an auditor cannot serve in an advocacy role for his or her client and 4 an. Therefore to the extent that a provision of the Commissions rule is more restrictive. The following are the five things that can potentially compromise the independence of auditors.

Non-assurance services and in-house audits. The AICPA Code of Professional Conduct requires that members in public practice be objective free of conflicts of interest and independent in fact and appearance section 300050. Auditors are expected to provide an.

Auditor Independence and IT Services April 26 2021 Jeffrey A. Consider whether your business falls within the definitionlist of an OEPI and whether the amended rules or new FRC audit independence rules will apply to. By Tammy Whitehouse 2005-08-02T0000000100.

Guidance for Auditor Independence. The pre-approval requirement would be waived for non-audit services that i were not recognized to be non. The European Union under rules that will take effect later this year will soon prohibit public interest entity auditors from preparing their clients tax returns and providing a variety of other tax services.

Provision of non-audit services. Providing financial planning services. For the purposes of this note members also includes affiliates provisional members and where relevant firms registered with ICAEW to carry out audits.

General Standard of Auditor Independence. Approved self-managed super fund SMSF auditors must comply with independence requirements as part of their professional obligations under the. However previous studies that have investigated the impact of audit firm-provided tax services on auditor independence in appearance and perceived.

The Commissions general standard of auditor independence is that an auditors independence is impaired if the auditor is not or a reasonable investor with. The proposal also would have banned value-added and advocacy fees for audit clients. Tue 26 May 2020 1200 GMT.

The independence requirements applying to auditors are legally enforceable and are located within the following legislation and standards. S-X 17 CFR 2102-01. APES 110 Code of Ethics for Professional.

This study examines whether auditors provision of tax services impairs auditor independence by focusing on auditors going-concern opinions among a. Ad Our integrated technology solutions simplify your audit and deliver enhanced quality. Guide to Library services.

Under the SECs rules auditors generally lack independence if a reasonable investor with knowledge of all relevant facts and circumstances would conclude that the accountant isnt capable of exercising objective and impartial. As mentioned in Rule 3500T the Boards Interim Independence Standards do not supersede the Commissions auditor independence rules. Audit committees should also be aware that the PCAOB has Ethics and Independence Rules Concerning Independence Tax Services and Contingent Fees.

National legal requirements - general. New Rules Adopted On Auditor Independence Tax Services. The Commissions auditor independence requirements with respect to services provided by auditors are largely predicated on four basic principles.

New Rules Adopted On Auditor Independence Tax Services. OCA oversees the resolution of. Our relentless focus on quality drives accurate results and transforms the audit process.

Start crossing things off your list today. Five Threats to Auditor Independence. The SEC requires auditors to be independent of their public audit clients both in fact and in appearance.

The AICPAs independence rules are codified in AICPA Rule 101 Independence. Core Accounting and Tax Service Bloomsbury Library. Moreover if foregoing auditor tax services does not enhance audit independence as some highly regarded research has concluded it.

Consider whether your business uses the same professional services firm for both audit and tax other non-audit services and whether there is an independence concern perceived or actual. The AICPA tax executive committee formed a working group to study and comment on the tax aspects of the SEC proposal. This EBPAQC tool helps auditors document their assessment of whether nonattest services performed for an EBP audit client impairs independence.

The DOLs independence rules are codified in DOL Interpretive Bulletin 75-9 29 CFR 250975-9. Accounting regulators have drawn an historic line in the sand between audit and tax services giving accounting firms another reason to act cautiously when providing tax services to audit clients. It is characterised by integrity and requires the auditor to carry out his or her work freely and in an objective manner.

At 17 emphasis added. Washington DC Apr. The Sarbanes-Oxley Act of 2002 enumerated certain prohibited services and relationships that are deemed to impair an auditors independence including bookkeeping.

The SEC asked for comments on whether providing tax opinions to audit clients would impair an auditors independence. Connect with a Accountant instantly. Auditor independence refers to the independence of the external auditor.

Ad Free price estimates for Accountants. The Public Company Accounting Oversight Board announced today that the Securities and Exchange Commission has approved PCAOB ethics and independence rules concerning independence tax services and contingent fees. See Rule 2-01 of Reg.

The rules introduce a foundation for the independence component of the Boards ethics rules by. 3523 Tax Services for Persons in Financial Reporting Oversight Roles. Under Sarbanes-Oxley Congress intended that an Auditor may engage in any non-audit service including tax services that is not on the list for an audit client only if the activity is approved in advance by the audit committee of the issuer Id.

866-463-3278 Contact The Center Contact the Center. The SEC likewise requires independence by the external auditors who perform an audit of managements assertions in the registrants. ICAEW Code of ethics part 4A.

This study examines whether auditors provision of tax services impairs auditor independence by focusing on auditors going-concern opinions among a sample of bankruptcy filing firms. The Commissions rules primarily through Regulations S-X address the qualifications of accountants including the independence requirements for auditors that issue audit attestation and review reports that form the basis for financial statements filed with the Commission. The evidence from the bankruptcy setting is particularly salient given that the bankruptcy of corporations such as Enron motivated several provisions of the.

Free estimates no guessing. For audits auditor independence is required by law in the United Kingdom and most other countries. Moreover if foregoing auditor tax services does not enhance audit independence as some highly regarded research has concluded it does not the disruption firms experience in.

A self-interest threat exists if the auditor holds a direct or indirect financial interest in the company or depends on the client for a major fee that is outstanding. Senate Report at 18. Tax Consultant In Kochi Ens Associates Pvt Ltd Accounting Services Professional Accounting Grow Business Gst Audit Company In Delhi And Bangalore.

Divisions 3 4 and 5 of Part 2M4 and s307C of the Corporations Act. Some believe that performing certain tax services for an audit client creates conflicts of interest that may impair auditor independence. Auditor independence tax services Saturday February 26 2022 Edit.

Pdf Auditor Independence In Fact Research Regulatory And Practice Implications Drawn From Experimental And Archival Research

Pdf Auditor Independence Current And Future Nas Fees And Audit Quality Were European Regulators Right

Pdf Non Audit Services Provided To Audit Clients Independence Of Mind And Independence In Appearance Latest Evidence From Large Uk Listed Companies

Pdf The Effect Of Auditor Characteristics On Tax Avoidance Of Iranian Companies

Pdf Non Audit Services And Auditor Independence Some Evidence From Malaysia

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

Pdf Is It Time For Auditor Independence Yet

Auditors Independence Ppt Download

Pdf Auditors Independence Experience And Ethical Judgments The Case Of Malaysia

The Importance Of Independence Of Your Auditor Exceed

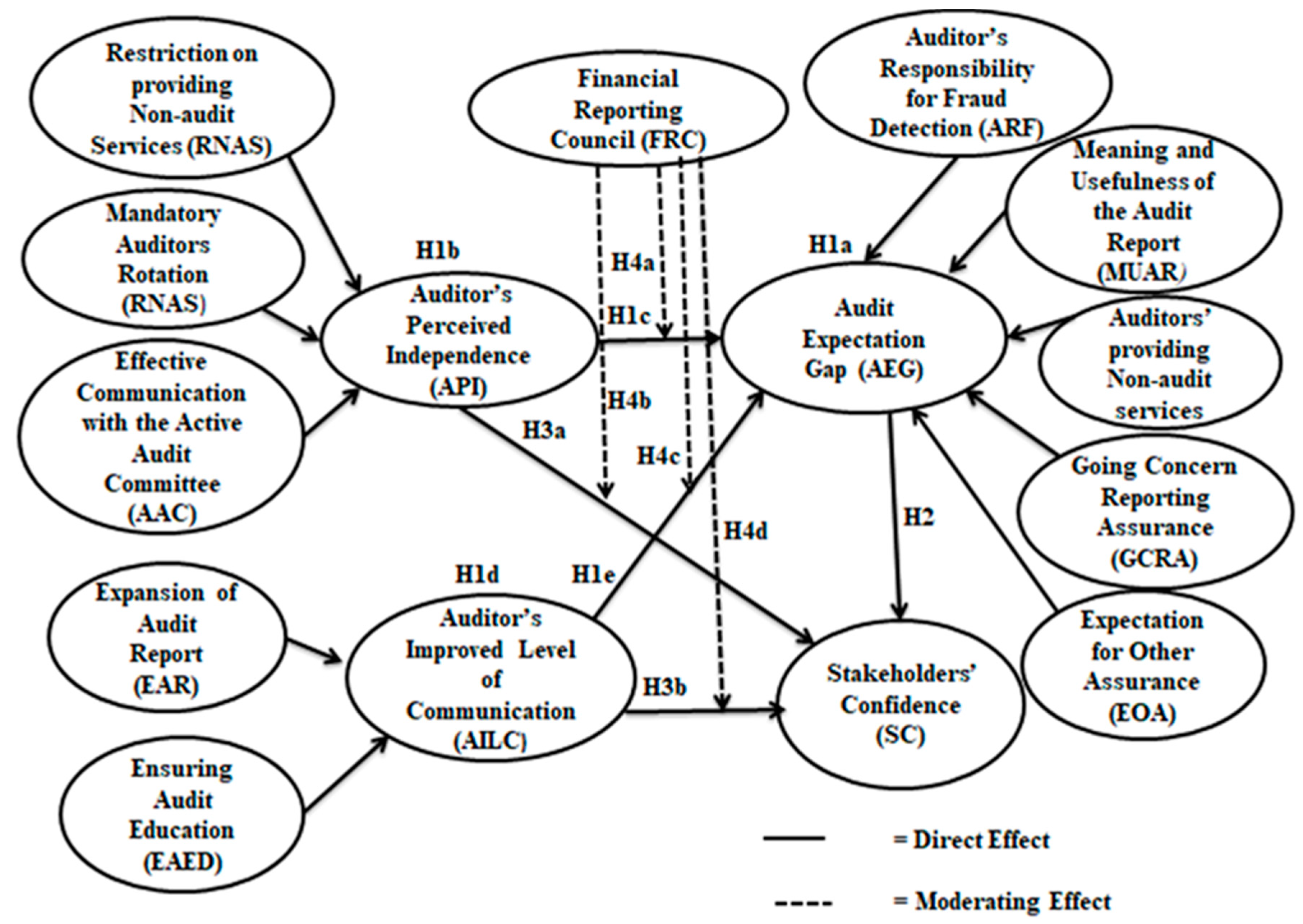

Ijfs Free Full Text Existence Of The Audit Expectation Gap And Its Impact On Stakeholders Confidence The Moderating Role Of The Financial Reporting Council Html